INCOME TAX RETURNS & ASSESSMENT

Income tax assessment is the process of collecting and reviewing the information filed by assessees in their income tax returns. At the end of each financial year, all persons and entities are required to file an income tax return by computing the amount of income earned and pay the tax liabilities.

GST Registration

GST enlistment applies to all people and substances providing labor and products in India. GST enlistment becomes compulsory when the total worth of supply surpasses Rs.20 lakh. The Ministry of Finance (MoF) worked on the GST enrollment technique to facilitate the assessment recording measure. On the off chance that the substance works in a unique class state, GST enlistment becomes pertinent if the worth surpasses Rs.10 lakh p.a. In this article, let us check out the qualification for acquiring GST enlistment. The article bays archives needed just as the GST enlistment method on the web.

GST Return Services

GST return is a document that will contain all the details of your sales, purchases, tax collected on sales (output tax), and tax paid on purchases (input tax). Once you file GST returns, you will need to pay the resulting tax liability (money that you owe the government).

Capital Gain Indexation

Indexation is utilized to change the price tag of a speculation to mirror the impact of swelling on it. A higher price tag implies lesser benefits, which successfully implies a lower charge. With the assistance of indexation, you will actually want to bring down your drawn out capital additions, which cuts down your available pay.

Property Tax

A property tax or millage rate is an ad valorem tax on the value of a property. The tax is levied by the governing authority of the jurisdiction in which the property is located.

TDS On Property

TDS is material on special of immovable property wherein the deal thought of the property surpasses or is equivalent to ₹ 50,00,000 (Rupees Fifty Lakhs). Sec 194 IA of the Income Tax Act, 1961 states that for all exchanges with impact from June 1, 2013, Tax @ 1% or 0.75% ought to be deducted (contingent on the Date of Payment/Credit to the Seller) by the buyer of the property at the hour of making installment of offer thought.

Property Valuation

The process of estimating the value of property is known as valuation. There are numerous methods of assessing the value of a property.

Accountancy Services

Accountancy refers to the services provided by a regulated professional accountant. Accounting refers to the processes of keeping or maintaining financial records. ... In many cases our core support to international clients comes from advice on corporate structures and related accounting and taxation arrangements.

Pan Card Services

Permanent Account Number (PAN) is a ten-digit alphanumeric number, given as a covered card, by the Income Tax Department, to any "individual" who applies for it or to whom the division dispenses the number.

Passport Services

Passport Seva Online Portal has been intended to convey Passport and related administrations to residents in an opportune, straightforward, more available, ...

Mutual Funds

A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities.

Tax Saving Schemes(ELSS)

Tax Saving Schemes is the most ideal way of making speculations to save charge by guaranteeing derivations accessible under the arrangements of the Income Tax Act, 1961.

TDS Return & Registration

TDS stands for Tax Deducted (or withheld) at Source. Income tax department mandates any company or individual to deduct tax at the source if the payment exceeds Rs. 50 lakhs for the purchase of goods and services, like rent, consulting, legal fees, royalty, technical services etc.

TCS Return & Registration

Tax Collected at Source, or TCS is a tax imposed on goods by the seller, who collects it from the buyer at the time of sale. Income Tax Act, 1961 specifies the goods and services on which TCS is applicable. The threshold for TCS on the sale of goods is Rs. 50 lakhs.

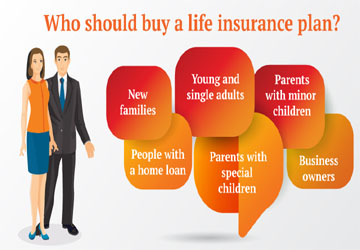

Life Insurance

Life insurance is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person. Depending on the contract, other events such as terminal illness or critical illness can also trigger payment.

Health Insurance

Health insurance or medical insurance is a type of insurance that covers the whole or a part of the risk of a person incurring medical expenses. As with other types of insurance is risk among many individuals. By estimating the overall risk of health risk and health system expenses over the risk pool, an insurer can develop a routine finance structure, such as a monthly premium or payroll tax, to provide the money to pay for the health care benefits specified in the insurance agreement

Vehicle Insurance

Vehicle insurance is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle.

LIC Premium Payment Services

This premium payment service is free at the franchisees or authorized collection centers and hence, the customer doesn't need to pay any commission/service tax..

Travel Insurance International

We are offering an exclusive International Travel Insurance Service. The offered service is performed by our experienced professionals using the qualitative tools and advanced techniques. The provided service is executed in the best possible manner within the stipulated time-frame.

PF/ESI Registration

Medical Benefit. Full medical care is provided to all persons registered under ESI and their family members – from the day the person enters insurable employment. ...

1.Sickness Benefit. ...

Disablement Benefit. ...

Dependant Benefit. ...

Funeral Expenses. ...

Unemployment Allowance.

Trade Mark Registration

The objective of the Trade Marks Act, 1999 is to register trade marks applied for in the country and to provide for better protection of trade mark for goods and services and also to prevent fraudulent use of the mark.

Shop & Establishment Registration

Every shop and commercial establishment should register itself under the Act within 30 days of commencement of business. The Certificate or the Shop License acts as a basic registration/license for the business.

MSME Registration

MSME registration is a mandatory process for any business to legally start and operate in India. The MSME registration is free of cost and is categorized under two main categories, such as manufacturing enterprises and service enterprises.

Tax Saving Bonds

Tax-saving bonds are great instruments offered by the government to help people save tax. These are special documents which offer tax benefits to the owners as permitted under the Income Tax Act.

Corporate Gifting,Home Personal

Corporate giving is the act of making a touchpoint with representatives, customers, or possibilities using a gift..

Business MSME Loans

(MSME) loan is the credit facility in form of a business loan offered by financial institutions to individuals, MSMEs, and Startup enterprises for business expansion purposes and to promote the MSME sector.

Digital Life Certificate

Digital Life Certificate (Jeevan Pramaan) is a biometric enabled digital service for pensioners. ... They need not visit the office of disbursing agency for physical submission of life certificate and instead may use the Aadhaar enabled biometric authentication mechanism to generate DLC.

PF Withdrawal

EPF can be somewhat or totally removed. Complete withdrawal is permitted when an individual resigns or then again on the off chance that he/she stays jobless for over 2 months. While, incomplete EPF withdrawal is permitted in specific situations including clinical purposes, marriage, home advance reimbursement, and so forth

Digital Signature Certificate (DSC)

Our firm is rendering Digital Signature Certification. To implement this service, we have selected a skillful team of professionals who hold prosperous acquaintance of this area. Furthermore, we render this service as per the details provided by our honored consumers.